Nvidia announced the 4-for-1 split that started trading July 20. In fact, the company’s expansion beyond gaming chips and into new technologies such as artificial intelligence, virtual desktops, machine learning and much more has powered Nvidia to new heights. In no way was Nvidia a bust just because one niche group of customers no longer had use for its products.

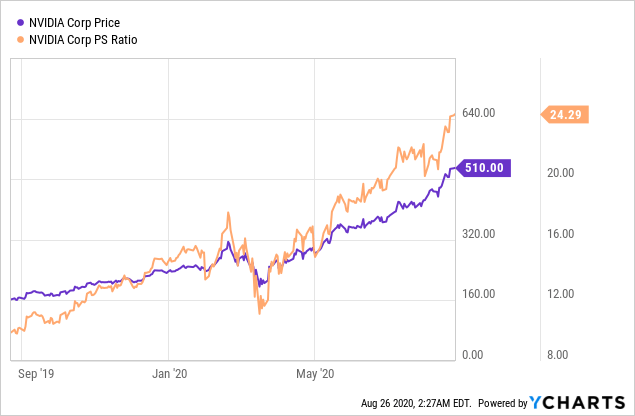

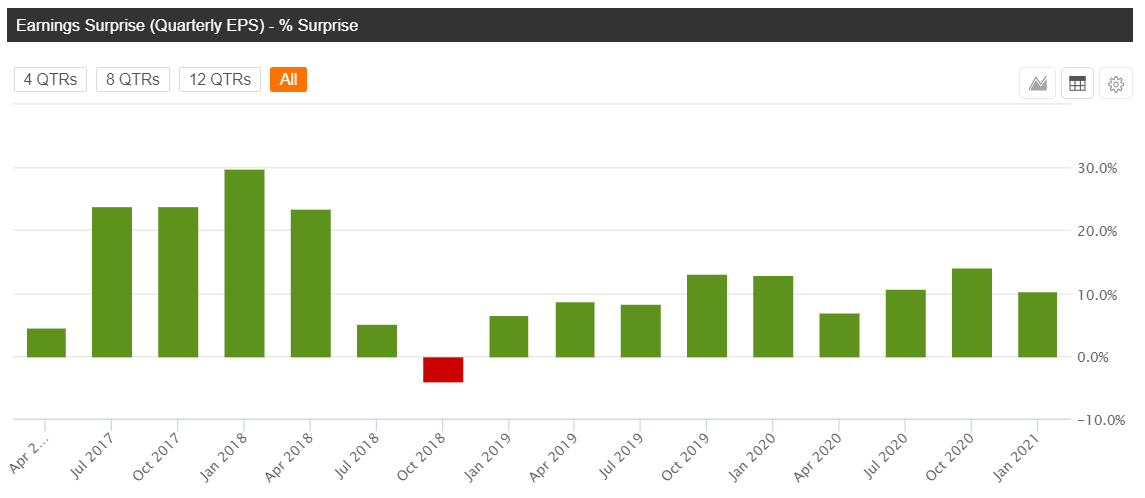

However, since mid-2019, NVDA stock hasn’t stopped climbing, from about $140 in June 2019 to more than $750 in July 2021 before a 4-for-1 stock split. When the Bitcoin market collapsed, so too did demand for the company’s cards, leading to a sharp decline in sales. The company was the victim of its own success, as Bitcoin speculators had spent the previous few months buying Nvidia’s high-performance gaming graphics cards to help mine the cryptocurrency. In late 2018, Nvidia shares crashed after third-quarter earnings disappointed investors and management lowered guidance below expectations for the fourth quarter.

The bottom line: Should you buy Nvidia stock?

The latter category has proven to be an unforeseen boon for a company that’s growing beyond gaming and into new markets at a rapid rate.Īfter the company beat expectations with its second-quarter earnings report in August, sending its stock on yet another rally, many investors might be wondering, “Should I buy or sell Nvidia stock?” Here are some points to keep in mind: The company, known for high-performance graphics processing units, processors and semiconductors, has evolved over the last few years, branching into self-driving cars, corporate workstations and data centers. But another tech stock that makes some of the technology that works behind the scenes has been enjoying an excellent year - up about 50% - without getting the spotlight it deserves: Nvidia Corp. ( FB) have been making headlines as they push the Nasdaq to new heights.

0 kommentar(er)

0 kommentar(er)